Inventory vs Supplies: Key Differences and Management Strategies

Do you know the difference between inventory vs supplies? Discover key distinctions and management strategies to optimize your business.

In this article:

- Why Understanding Inventory vs Supplies Matters

- What is Inventory? A Clear Explanation

- Inventory as a Financial Asset

- What are Supplies? How They Support Daily Operations

- Inventory vs Supplies: Key Differences You Need to Know

- 1. Purpose in the Business

- 2. Accounting Classification

- 3. Impact on Profitability

- 4. Storage and Tracking

- 5. Valuation

- Inventory and Supplies Management Strategies

- Inventory Management Strategies

- Supplies Management Strategies

- Take Control of Inventory and Supplies Before They Control You

One of the most overlooked causes of waste in business operations is a simple misunderstanding: not knowing the difference between inventory and supplies. It might seem minor initially, but this mix-up can lead to serious financial consequences.

Inventory includes items you sell to customers, like finished goods or raw materials. Supplies, on the other hand, are used to run your business, things like packaging, office materials, or cleaning products.

If you mix them up, you could end up in a bad financial condition. So, how can you manage both effectively? That’s what we’re here to find out. Let’s dive in.

Why Understanding Inventory vs Supplies Matters

Knowing the difference between inventory and supplies is all about making smarter financial decisions and running your operations more efficiently. When these two are misclassified, it can lead to budget misallocations, inaccurate financial reporting, and operational inefficiencies that cost businesses thousands annually.

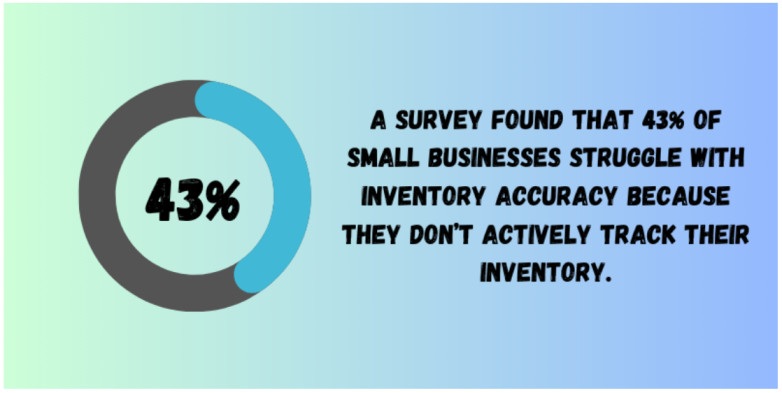

A survey found that 43% of small businesses struggle with inventory accuracy because they don’t actively track their inventory. It is mostly due to the confusion between what should be tracked as inventory and what counts as consumables or supplies.

Source: Packagex

Moreover, understanding the inventory vs supplies distinction allows businesses to track assets more accurately, budget more properly and optimize their recording systems and shelf space.

What is Inventory? A Clear Explanation

Inventory refers to the goods or materials a business holds with the intent to sell, produce finished products, or support sales operations. In simple terms, if it helps generate revenue, it’s likely inventory.

From retail shelves to factory floors, inventory plays a direct role in your business’s profitability. It’s also about what you sell, not just what you store.

Inventory as a Financial Asset

Inventory is considered a current asset on your company’s balance sheet. According to accounting guidelines such as GAAP and IFRS, it must be valued accurately to reflect its impact on profits, cash flow, and overall business health.

If the inventory is incorrectly tracked, it can lead to overstated or understated profit margins, poor pricing strategies, and inaccurate tax filings. On the other hand, companies that implement real-time inventory tracking are 35% more likely to avoid costly stockouts or excess inventory.

Source: Firework

What are Supplies? How They Support Daily Operations

While inventory contributes directly to revenue, supplies are the unsung heroes of your business’s daily operations. These are the materials you use within the organization to keep workflows running, but they’re not sold to customers.

Supplies are the behind-the-scenes tools that help your business function smoothly, even though they don’t appear on your product listings or sales reports.

They are typically expensed when used, not stored as assets (unless purchased in bulk or unused at year-end). Misclassifying them as inventory can skew expense reports and affect profitability analysis.

Inventory vs Supplies: Key Differences You Need to Know

At a glance, inventory and supplies might seem similar, but they are not. Here are the key distinctions between the two:

1. Purpose in the Business

The main difference between inventory and supplies starts with their purpose. Inventory includes anything your business purchases or produces to sell or use to make a product. It directly drives revenue. For example, if you own a bakery, your inventory includes flour, eggs, and the cakes you bake.

Supplies, in contrast, are materials your business uses internally to operate. These aren’t sold to customers and don’t contribute to revenue directly. The examples include receipt paper, hand sanitizer, cleaning materials, and office pens. Though they are essential for running the business, they don’t have resale value.

2. Accounting Classification

Inventory and supplies are also treated very differently in accounting. The former is listed as a current asset on your company’s balance sheet. This means it’s considered something valuable that the business owns and plans to turn into cash soon, usually by selling it.

Supplies are usually recorded as operating expenses. They are expensed when used, not when purchased. If you buy office paper in January but use it throughout the year, the cost is recognized as an expense only in the month the paper is consumed, not when it’s purchased or stored.

3. Impact on Profitability

Inventory plays a direct role in your business’s profitability. When you manage inventory well, you can meet customer demand without overstocking. This balance helps reduce holding costs, prevent spoilage (in the case of perishable goods), and avoid tying up cash in unsold items.

Even though supplies aren’t sold directly, they can also affect overall profit. Without the necessary tools and materials, productivity suffers. For instance, a print shop can't function properly without toner, and a restaurant can't maintain hygiene without cleaning supplies.

4. Storage and Tracking

Businesses store and track inventory more thoroughly than supplies. Inventory usually requires specific locations, labeling (like SKUs or barcodes), and regular monitoring. Many companies use inventory management software to keep track of item counts, locations, expiration dates, and even reorder levels.

Supplies, however, don’t require the same level of documentation. While knowing you have enough supplies is essential, they are typically tracked in bulk or through simple checklists and reorder routines. For example, you might reorder printer paper when you see the last box being opened. These supplies don’t usually need per-item tracking unless they’re highly valued.

5. Valuation

Valuation refers to how a business determines the cost of its inventory. Common valuation methods include FIFO (First In, First Out), LIFO (Last In, First Out), or weighted average cost. These methods help companies calculate the worth of their inventory and the cost of producing or purchasing it.

Since inventory is part of your assets and taxable income, how it’s valued affects everything from business loans to taxes. Supplies don’t require such complex valuation as they’re typically used shortly after purchase, and their value is recognized as an expense when consumed.

Inventory and Supplies Management Strategies

Not managing inventory and supplies can cause tons of problems for businesses. Here’s how you can manage both of these independently in the best way:

Inventory Management Strategies

If you’re looking to properly manage your inventory, you need to do the following.

1. Implement a Real-Time Inventory Tracking System

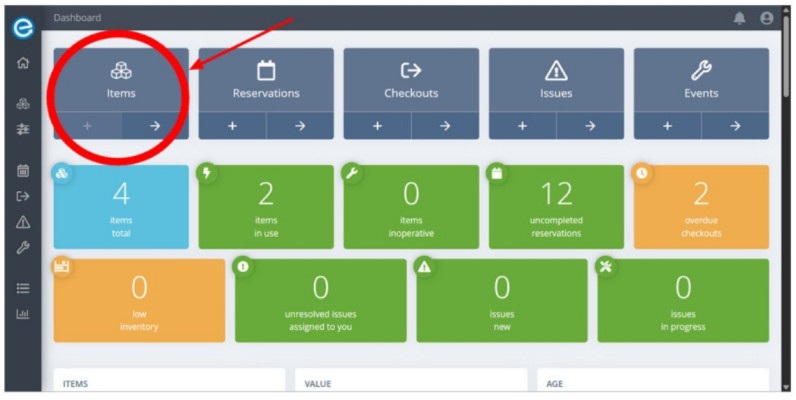

Relying on spreadsheets or manual logs can lead to serious mistakes. That’s why businesses need to switch to an equipment inventory management software such as Itefy.

This system gives you up-to-date visibility on stock levels, item locations, and reorder needs.

As the image above shows, you can easily add items to your Itefy dashboard and track them whenever you want to.

2. Use ABC Analysis to Prioritize Stock

Not all inventory carries the same weight. That’s why it’s best to use ABC analysis to group different time into levels:

- A-items: High-value, low-quantity items (e.g., electronics)

- B-items: Moderate value and demand

- C-items: Low-cost, high-quantity items (e.g., packaging)

By using ABC analysis, teams can prioritize their time and resources where it matters most. It’s a practical way to reduce waste, avoid stockouts, and improve overall inventory performance.

3. Perform Regular Inventory Audits

Auditing helps catch discrepancies, shrinkage (loss due to theft or errors), and miscounts. Use cycle counting, where you audit a small portion of inventory daily or weekly, rather than doing a massive annual count.

These asset management audits help improve accuracy and strengthen confidence in your data, especially when preparing financial statements or tax filings.

Supplies Management Strategies

For people struggling with managing their supplies, here’s what you should be doing:

1. Track Supplies with Usage Logs

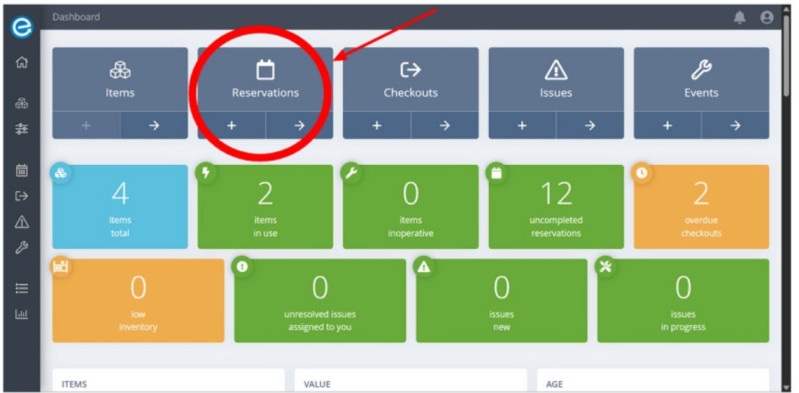

Keeping track of supplies is often overlooked, yet it’s key to reducing unnecessary costs and improving accountability. With Itefy’s inventory management tools, businesses can log usage details like who checked out an item, when it was used, and for what purpose.

This kind of tracking ensures that every piece of equipment or supply is accounted for at all times. Knowing where everything is (and who last used it) helps reduce loss, prevent delays, and improve operational efficiency.

2. Buy in Bulk (But Strategically)

Purchasing supplies in bulk can lower costs per unit. However, it’s essential to ensure you actually use what you buy. Focus only on high-usage and non-perishable items (e.g., paper towels, packaging tape).

For example, if you run a café, buying 6 months’ worth of napkins makes sense. However, buying a year’s supply of seasonal decor may result in wasted storage and expense.

Take Control of Inventory and Supplies Before They Control You

By understanding the difference between inventory and supplies, you can build smarter operations, budget properly, and grow your business long-term. However, knowing the theory alone isn’t enough; you also need the right tools to put it into action.

That’s where Itefy comes in.

If you’re tired of guessing where your equipment is and what supplies are running low, we’re here to help. Itefy’s Equipment Management Software can help you track your inventory and also keep an eye on maintenance schedules.

Get a 14-day free trial today to see how we can make your business operations cost-effective.

Frequently Asked Questions

-

Businesses can prevent stock outs by forecasting demand more accurately and setting the right reorder points. It's also important to keep safety stock on hand. If you manage to build a strong relationship with the supplier, your inventory will always arrive on time.

-

EOQ is a formula that determines the optimal order quantity, minimizing the total inventory costs, including ordering and holding costs. By calculating EOQ, businesses can make informed purchasing decisions to maintain cost-effective inventory levels.

-

The four types of inventory are raw materials, work-in-progress (WIP), finished goods, and maintenance, repair, and operations (MRO) inventory. Each type of service plays a distinct role in the production and sales process to help businesses manage their resources.