A Step-by-Step Guide to Perform an Asset Management Audit

Are you looking for a way to perform an asset management audit in your organization? Click here to read a step-by-step guide on how you can do it with ease.

In this article:

- The Asset Management Audit Checklist: A Step-by-Step Guide

- 1. Get Your Organization Ready for Asset Management Audit

- 2. Create an Asset Register

- 3. Develop Asset Management Audit Procedures

- 4. Evaluate the Condition of the Assets

- 5. Determine the Value of Assets

- 6. Set Asset Lifespan and Depreciation

- 7. Reporting and Preparing for the Next Asset Management Audit

- Simplify Your Asset Management Today – Get Started with Itefy!

It is important for officials working in any industry to keep an eye on their physical and tangible assets by doing asset management audits.

Solid asset management audits ensure that everything from equipment to software is tracked, maintained, and optimized. It not only improves the operational productivity of employees but also saves money that could've been lost due to unplanned downtime.

This article explains how to perform an asset audit so that your assets don’t become a liability in the long term. Keep reading to learn more!

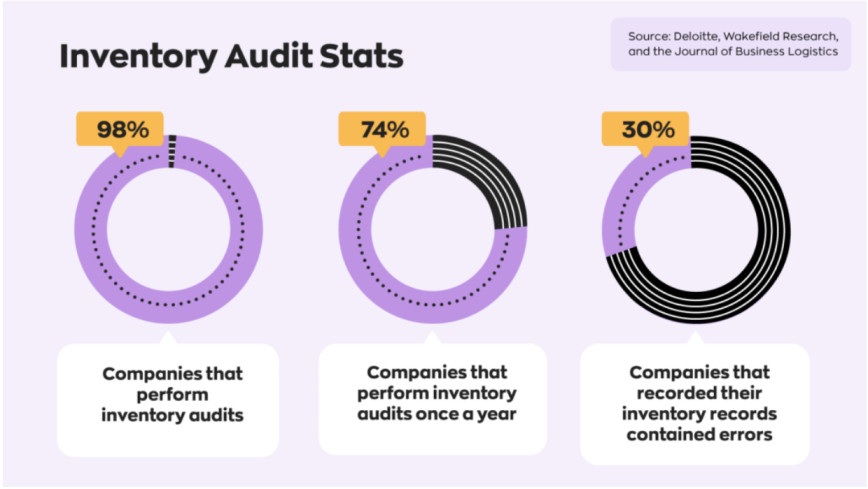

Source: inFlow Inventory

The Asset Management Audit Checklist: A Step-by-Step Guide

It’s important to create an asset management audit checklist to maintain the integrity and efficiency of your asset management audit. Here’s how you can conduct it.

1. Get Your Organization Ready for Asset Management Audit

To ensure a successful asset management internal audit, it’s important to plan well in advance. Here’s how you can get your organization ready for it:

- Schedule the asset management audit: Set firm dates to keep everything on track.

- Organize teams: Assign specific tasks and roles to your team members.

- Identify key data sources: Gather your information and put together a clear checklist.

- Allocate necessary resources: Ensure you have the staff, time, and access to records.

- Choose the audit tool: Select the right platform to document and manage the process.

2. Create an Asset Register

The next step in this asset management audit is to create a digital asset register. It’s extremely important, as the average financial impact of poor-quality data on organizations is $9.7 million annually. This asset register is a centralized system that holds all vital information about the assets your business owns. It includes details such as the location, description, serial number, and the number of items.

When creating your asset register for a physical audit, include the following details:

- Location: Note the exact location of each asset to make tracking and audits easier.

- Manufacturer, Model, and Serial Number: These details help you accurately identify and differentiate between similar assets.

- Purchase/Installation Data: This is essential for tracking asset depreciation, planning replacements, and scheduling maintenance.

- Specific Asset Data: Record additional details like maintenance history, warranty information, or technical specifications that help with audits and ongoing physical asset management.

You can also use asset tracking software like Itefy to gain access to advanced features like tracking supplier information, full asset history, and maintenance records.

Source: Supply Chain Connect.

3. Develop Asset Management Audit Procedures

After creating an asset register, the next step is to establish clear asset management audit procedures and policies. These ensure that all assets are properly tracked, maintained, and accounted for in a consistent manner. Here’s what you can do:

- Check-in and Check-out Protocols: Define how assets will be checked in and out of the system. This includes assigning responsibility for asset handling and setting guidelines for when and how assets are moved, transferred, or assigned to different departments.

- Approval Processes: Set up approval workflows for the movement or disposal of assets. This helps maintain accountability and ensures that assets are properly authorized before any major changes occur.

- Reporting Requirements: Outline how and when asset reports will be generated. This should include details on asset utilization, condition, asset maintenance history, and depreciation.

- Audit Trail and Documentation: Maintain an asset management audit trail that documents all actions taken on each asset.

Do you know that 80% of equipment maintenance is reactive? This highlights the importance of staying ahead in order to keep your assets in the best condition.

Source: GoCodes

4. Evaluate the Condition of the Assets

Next, you need to evaluate the condition of your physical assets. You're going to need a proper team to make this step work. To make this step easier, do the following:

- Use Identification Numbers: Ensure that every asset has an identification number or asset tag, which will help reconcile the physical asset with the records. This is crucial for confirming that all listed assets are accounted for.

- Conduct Condition Assessment: During the inspection, teams should assess the physical condition of each asset. It includes checking for signs of wear, tear, and damage.

5. Determine the Value of Assets

Determining the value of your company’s assets is a crucial step in the asset management audit process. Here’s how you can accurately assess asset value:

- Categorize Your Assets: Start by identifying and categorizing assets as either tangible (e.g., equipment, machinery) or intangible (e.g., patents, trademarks).

- Assess Purchase Price and Deprecation: Use the original purchase price and apply appropriate depreciation methods (e.g., Straight-Line Method) to determine the asset’s current value.

- Market Value Comparison: For certain assets, especially real estate, you may need to compare the asset’s current market value.

- Impairment Testing: Determine if any assets are impaired, meaning the asset’s book value is higher than its recoverable amount.

6. Set Asset Lifespan and Depreciation

Determining the lifespan and depreciation of your assets is important for effective asset lifecycle management. This step ensures that the declining value of your assets is accurately reflected in financial reports. Follow these points to do it efficiently:

- Consistency in Depreciation Methods: Apply consistent depreciation methods for similar types of assets. Consistency ensures that your financial statements are accurate and reliable.

- Useful Life Assessment: Regularly reassess the useful life of your assets. Over time, you may find that an asset’s lifespan is shorter or longer than originally estimated. When this happens, it’s important to adjust the depreciation schedule.

- Residual Value Review: Residual value refers to the asset’s worth at the end of its useful life. Periodically reviewing this value helps ensure that depreciation is calculated correctly.

7. Reporting and Preparing for the Next Asset Management Audit

The final step in the asset management audit process is creating a report that explains everything you’ve found throughout the audit. This report provides a clear overview of your assets' current state and highlights any areas for improvement.

- Audit Report: Begin the report with a summary that outlines the key findings, a section that covers discrepancies, asset valuations and condition assessments. It should also include actionable recommendations to resolve issues such as asset mismanagement, necessary repairs, or improvements in asset tracking.

- Follow-up Action: After submitting the audit report, taking action based on the recommendations is important. This may include updating asset management policies, improving record-keeping, and scheduling follow-up audits. You can also use an equipment maintenance log to keep an eye on all your assets.

Source: Scaleflex

Simplify Your Asset Management Today – Get Started with Itefy!

Performing an asset management audit is important for maintaining accurate records, determining asset value, and ensuring that your business is running efficiently.

If you’re looking for a platform that can simplify asset management, then Itefy is your best bet. With Itefy, you get an all-in-one platform that helps you track asset location, condition, value, and maintenance schedules.

So, what are you waiting for now? Start your 14-day free trial today and experience the full power of this software.

Frequently Asked Questions

-

To fix the assets audit, follow these steps:

Verify the asset's physical existence.

Check asset classification to confirm it’s categorized correctly.

Confirm the asset’s location matches your records.

Review the purchase data to track the asset’s age.

Check the original cost for accurate financial records.

Ensure proper labeling with a barcode or ID number.

Assess the working condition to make sure it works properly. -

An asset audit is the process of reviewing all of your assets to verify their current status and provide an accurate picture of what you actually own. It ensures that the assets are handled transparently, accurately, and responsibly. It helps organizations track, maintain, and optimize their resources accurately.