Fixed Asset Tracking Best Practices [5 simple steps]

Getting the most out of your fixed assets is crucial. Here are 5 of the most important measures to get the best return on your equipment inventory investments.

In this article:

- 1. Record Check-ins and Check-outs of Assets

- 2. Take Advantage of Barcodes for Asset Tracking

- 3. Use Lifecycle Management for Asset Depreciation

- 4. Perform Audits for Compliance Purposes

- 5. Automate Asset Accounting

- Maximizing Return on Investments (ROI) with Fixed Asset Software

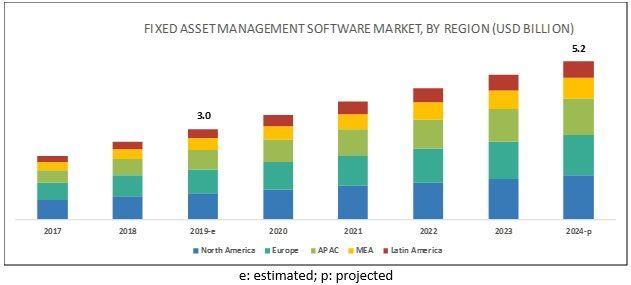

A Markets and Markets report revealed that the fixed asset management market would grow up to $5.2 billion by 2024 at a Compound Annual Growth Rate (CAGR) of 11.8%.

This is primarily because of the increasing need for businesses to minimize operational expenses and generate revenues through efficient asset management. A fixed asset management software centralizes asset information for easy auditing and reporting and helps ensure that fixed assets stay in top condition throughout their entire lifecycle.

After all, the main objective of fixed assets management is to streamline asset allocation and ensure all related asset information is retained for easy discovery. Unfortunately, navigating a fixed asset management solution can be tricky, especially if you have little to no knowledge about managing and updating processes to reflect changes in the organization's environment.

Some of the fixed asset management best practices that can help you manage fixed assets comprehensively and prevent confusion between employees and skewed numbers in your record are outlined in this piece. Use these tips to upgrade your management techniques and avoid the risks of unauthorized breaches.

1. Record Check-ins and Check-outs of Assets

Checking in and checking out assets are standard practices for employees working in an office or on off-site projects. An example of this is the construction industry, wherein managers and contractors use various assets like a truck, heavy equipment, and machines to build buildings and infrastructures.

Poor asset management can lead to massive losses for construction companies. This is why it is essential to know and estimate the lifespan of each of your assets. Using a fixed asset management solution for your construction business allows you to conduct an in-depth construction estimating process to understand when you should replace your old assets and make wise purchases.

2. Take Advantage of Barcodes for Asset Tracking

The importance of fixed asset management lies in the ability to reduce overhead by improving equipment tracking and loss prevention. One way to help minimize cost is to use barcode labels to monitor asset movements to ensure higher visibility of all your assets.

Moreover, barcode technology provides your business with immense flexibility and accuracy than traditional asset management ever can. By taking full advantage of fixed asset management software with barcode capabilities, your business can immediately gain up-to-date information about your assets and determine which assets are going to be needed in the future based on reservations.

3. Use Lifecycle Management for Asset Depreciation

Another crucial aspect of fixed asset management is to monitor the depreciation of all your fixed assets. More often than not, a fixed asset lifecycle consists of multiple stages that include planning, acquisition or procuring, depreciation, maintenance, and disposal.

With a fixed asset management software, you will be able to monitor different phases of an asset's life closely. This enables you to determine how your assets are deteriorating and inform you when their maintenance is due. Through this process, you can gain accurate depreciation estimation and schedule repair sessions on time to keep your fixed assets in top shape.

4. Perform Audits for Compliance Purposes

The majority of fixed asset management software is armed with audit modules that you can use to gain a clear picture of your business. Performing frequent audits helps your business quickly identify assets that need to be addressed and develop a consistent process to remain compliant with industry standards.

The equipment management software market is growing at a rapid pace. This is primarily because of the increasing need for businesses to minimize operational expenses and generate revenues through efficient asset management.

Besides staying compliant, asset auditing lets you identify and eliminate ghost assets to ensure improved budgeting for future capital expenditures. With asset auditing, you will not only be able to come up with adequate insurance coverage of the assets but also identify property tax-saving opportunities and optimize return-on-asset ratios.

5. Automate Asset Accounting

Fixed assets are typically high-value, long-term, and revenue-producing items. Thus, there are inevitably multiple areas in which the management of such assets must adhere to operational and legal procedures and accounting. Automating asset accounting enables you to not only enhance control of time costs on depreciation calculation but also generate monetary returns in optimized practices.

A fixed asset management software focuses on delivering a more precise accounting using built-in rules for asset bookkeeping that monitor depreciating asset costs throughout their lifecycles. Furthermore, this can help you eliminate paperwork and human error, which are essential in empowering you to make effective business decisions on your existing fixed assets.

Maximizing Return on Investments (ROI) with Fixed Asset Software

Automated and simplified asset management is critical for enhancing the overall operational efficiency of your IT administration. With an efficient, fixed asset management solution, your business can simplify the challenging process of searching, locating, and updating the current locations of all monitored assets easily and quickly, thus, maximizing the return on investments on assets.