Importance of Having an Asset Database for Insurance: A Complete Guide

An asset database for insurance works as a digital repository for all of your valuables, maintaining a detailed record of each asset. Learn more here.

In this article:

- What is Asset Insurance?

- Asset Database for Insurance Purposes

- What Should Be in an Asset Database?

- Benefits of Maintaining an Asset Database for Insurance

- Accurate Valuation

- Streamlined Claims Process

- Strong Proof of Ownership

- Better Risk Management

- Equipment Inventory Database and Insurance

- Conclusion

No level of disaster protection or theft alarms can fully shield your assets from the unpredictability of life — except for being prepared. Imagine losing your valuable assets in a disaster and struggling to remember all the details to file an insurance claim. Sounds overwhelming, right? This is where an asset database for insurance comes in.

It maintains an updated catalog of all your assets, from electronics and furniture to machinery and collectibles. This results in a reliable register that simplifies the claims process, ensuring you receive the compensation you’re entitled to. But how does an asset database for insurance streamline the process of recovering losses? Read on to find out.

What is Asset Insurance?

According to the Federal Emergency Management Agency (FEMA), 40% of businesses (without insurance coverage) never reopen following a disaster. This highlights the importance of asset insurance in business continuity and financial stability. But what is asset insurance, exactly?

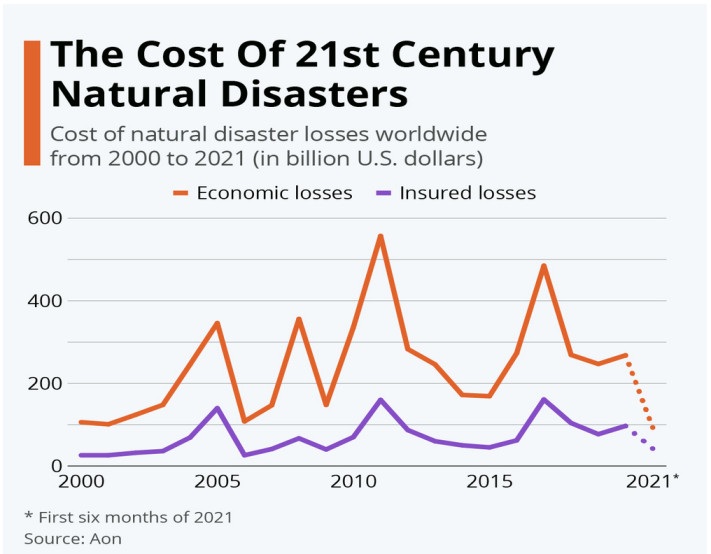

Cost of natural disasters

Asset insurance covers a company’s physical and financial assets from unexpected events like accidents, theft, or natural disasters. It is a safety cushion that helps your business resume smooth operations even after a major loss. For many companies, asset insurance includes everything from office furniture and equipment to inventory, machinery, and intellectual property.

When you opt for asset insurance, you’re basically transferring the financial risk of these assets to the insurance provider. This means if they’re damaged, lost, or broken, the insurer will pay the cost to repair or replace them. As a result, your business’s operations are protected in case of unanticipated events.

Asset Database for Insurance Purposes

An asset database for insurance refers to a systematic record of a company’s valuable assets. In other words, it is a digital repository that contains detailed information about each asset. The basic role of an asset database is to maintain a detailed inventory that can be referenced for insurance-related activities. These include filing claims, managing coverage, and providing asset ownership.

What Should Be in an Asset Database?

To maintain a reliable asset insurance database for claims and other purposes, you should know how to track inventory and what details to include. Each asset entry should capture the following information:

- What is the name of the manufacturer, model, and serial number of the asset?

- Details of any maintenance, repairs, and servicing performed

- Insurance details (policy number, coverage limits, claims history)

- The exact location and purpose of each asset

- Purchase date and vendor details

- Invoice of the purchase price and terms

- Current market value of the asset

- Depreciation value

- Estimated life expectancy (Useful life)

Benefits of Maintaining an Asset Database for Insurance

Better asset management improves the operational efficiency of your business and also leads to financial stability. In the business world, the better protected your assets are, the less downtime your operations face in case of uncertain events. One way to shield your valuables is to maintain an up-to-date asset database for insurance, which has a number of benefits.

Accurate Valuation

An up-to-date asset database for insurance companies ensures that your business’s coverage aligns with the value of your assets. This helps avoid underinsurance, where your assets are valued less than their actual worth. Thus, having an accurate asset register ensures you’re rightly compensated in the event of damage or theft.

Streamlined Claims Process

Without an updated asset database for insurance, filing claims becomes a nightmare. You have to examine a hundred invoices and documents to find an asset's purchase value, vendor details, and even maintenance records.

However, with a well-organized asset register, you can quickly provide insurers with detailed information about the asset in question. This expedites the claims process and improves the chances of your business receiving favorable compensation.

Strong Proof of Ownership

In 2022, 1 in 5 individuals experienced a denied insurance claim, which usually stem from insufficient or inaccurate documentation. This is where an asset database helps, serving as a strong proof of ownership and value. If you have a detailed record of what you own, you’re less likely to face disputes in the claims process. It also positions you better to defend your claims.

Better Risk Management

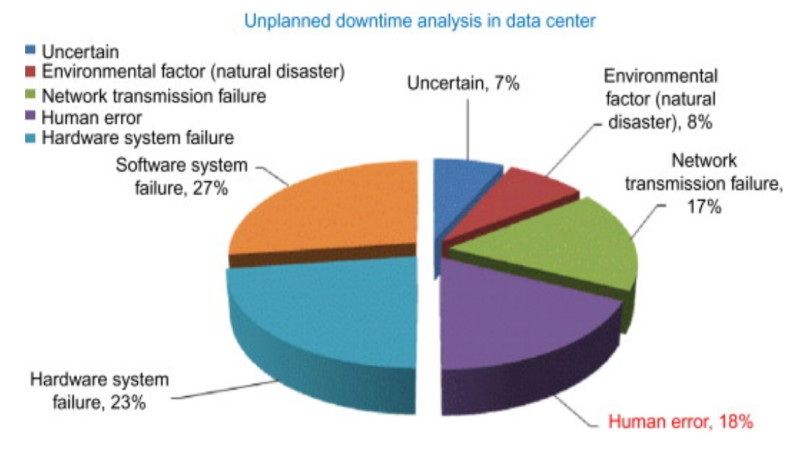

According to Business Wire, 82% of companies have suffered at least one unplanned asset downtime in the past three years, leading to lost productivity and potential revenue. An updated asset database helps you manage these risks better by maintaining a track record of the value and condition of your assets. This helps you spot potential risks and implement fixes on time.

Unplanned downtime analysis

Equipment Inventory Database and Insurance

No asset insurance strategy is complete without an equipment plan, a set of tools that keep your production lines running. To strengthen your overall insurance plan, it’s imperative to maintain an equipment inventory database alongside the asset register.

This database holds a comprehensive record of all the equipment your business owns, including its specifications, location, and value. It also maintains an equipment maintenance log. This record book provides the necessary documentation to support your insurance claim in case of theft, fire, or damage to your equipment.

Conclusion

In the competitive business environment, it’s essential to keep your assets protected. This ensures that you can get your operations running quickly following any uncertain event. An up-to-date asset database for insurance helps you do this, maintaining a detailed, ready-to-fetch record of your valuables. The result is smooth claims processing and favorable compensation.

To fully reap the benefits of an asset inventory database, pair it with Itefy’s Asset and Equipment Management Software. With Itefy, you can organize, schedule, and manage your equipment on the go — so you’re always prepared for any insurance issues that may arise.

So, sign up now and gain full control of your equipment inventory!

Frequently Asked Questions

-

Insurance companies hold many financial and non-financial assets to ensure they can meet financial obligations and manage risks. These include admitted assets (that can be used to fulfill policyholder obligations), invested assets (like the bond market, money market, and stock market), and non-admitted assets (prepaid expenses, office furniture).

-

Yes, there are databases and management systems for insurance policies. These records are used by insurance companies to store and manage policyholder information, policy details, claims data, and more.